Kickstarter publishing category growth in seven charts

Working with Stat Significant, we were able to break down the history of the Kickstarter publishing category between 2013 and 2021.

Hi friends,

Most platforms are a black box of data, especially publishing platforms like Amazon. Kickstarter has always been the exception. For instance, you can research campaigns dating back to the beginning of the platform. Companies like Kicktraq have used this freedom of data to help creators track their projects and find patterns in their own work.

I’m very interested in data, especially longitudinal data. One of my degrees is in sociology with a focus on demographics, so when Daniel Parris of Stat Significant emailed to ask if I was interested in doing a data analysis of the publishing category on Kickstarter, I jumped on the chance.

I’ve talked numbers with Oriana, publishing director of Kickstarter, so many times in my career, but to see how Daniel captured the changes in the platform was incredible.

If you don’t know Kickstarter, then here’s a bit about them in their own words.

Since our launch, on April 28, 2009, 23 million people have backed a project, $7,767,775,921 has been pledged, and 252,077 projects have been successfully funded.

We're an independent company of passionate people working together. We spend our time designing and building Kickstarter, forging community around creative projects, and supporting the creative ecosystem around us. We’re developers, designers, support specialists, writers, musicians, painters, poets, gamers, robot-builders—you name it. Over the years, our team has backed more than 50,000 projects (and launched plenty of our own). -Kickstarter

If you don’t know Daniel’s work, then I highly suggest you check out Stat Significant.

Stat Significant is a free weekly newsletter featuring data-centric essays about culture, economics, sports, statistics, and more. Each week I attempt to answer big thorny questions using data analytics.

My name is Daniel Parris, and I'm a California-based data scientist and journalist who writes about the intersection of statistics and pop culture. I initially majored in film, working briefly in the entertainment industry, before a 6+ year stint at DoorDash, joining the company when it was ~150 employees. -Stat Significant

Here’s a recent one that I loved.

If you don’t know my history with Kickstarter. Not only have I raised over $500,000 across more than 30 publishing projects on the platform, but I’ve also helped thousands of creators raise millions of dollars for their projects with my business partner Monica Leonelle through our book, Get Your Book Selling on Kickstarter, Kickstarter Accelerator course, and Kickstart Your Book Sales podcast.

If you want to learn more about Kickstarter, paid members have access to my Fund Your Book With Kickstarter course, along with lessons and lectures I’ve given about crowdfunding throughout my career. You can start your paid membership with a 7-day trial, or just give us a one-time tip to show your support.

Daniel pulled this together from some Kickstarter datasets he found on Kaggle, a machine-learning and data scientist community that seems to have endless interesting stuff, and a public-use dataset found on the National Archive of Data on Arts & Culture.

As with most data, it’s not current. This data runs from about 2013 through January 2021. It just so happens that Monica and my work together around Kickstarter started in earnest in October 2021, so what I thought we would do is have Daniel talk about the historical context of this data, and then I can chime in with contextual information to bring us up to present, and also give my interpretation of the data.

To give some context:

As of November 2023, the success rate of fully funding a project on the crowdfunding website Kickstarter was 41.02 percent. In other words, more than four out of ten projects on Kickstarter was successfully funded, while roughly six out of ten projects were unsuccessful. -The Crowdfunding Formula

Daniel: For this view, we’re examining fundraising success over time for a handful of categories, including publishing, music, games, and technology. Interestingly, all fundraising categories improved their campaign success over the last ten years, likely due to Kickstarter platform improvements, higher-quality fundraisers, and better macroeconomic conditions. All fundraising categories saw a spike in campaign success resulting from the economic shock of the COVID-19 pandemic—Kickstarter clearly provided entrepreneurs a financial lifeline during this time.

Russell: What really interests me about this data is how the success percentage of the publishing category shot up in the past ten years from about 30% to close to 60%. I know from my conversations with the Kickstarter staff that number is way higher today, especially when you factor in campaigns that have more than 25 backers. I think it’s closer to 80% if you take those into account.

It’s wild that a category like Technology could actually decrease. Meanwhile, both Film & Video and Games started at almost exactly the same place and diverged wildly. Games is now one of the stronger categories on the platform, if not the strongest when you combine the success percentage with the total category revenue.

Daniel: This chart examines the mix of projects on Kickstarter over the last ten years, broken down by category type. In many ways, Kickstarter is a marketplace for altruism, with consumers giving money to causes and products they support. Over time, demand for certain project types may change. In this instance, we see a relative decline in film & video, music, and theater projects (all performing arts) over this ten-year stretch while simultaneously witnessing growth in the game, technology, and design categories. It’s hard to say what exactly drove these trends. Perhaps fundraising demand on Kickstarter matches the economic reality of these categories outside the platform, or maybe people got burned by similar projects in the past (like Zach Braff’s unfortunate Kickstarter campaign for Wish You Were Here).

Russell: This is always the hardest graph for me to analyze. I struggle with it, and I had to get my wife, a research director who works with a lot of graphs, to help me see the insights from this one, but once she did a lot of things stood out. First of which is how much the Film and Video category shrunk relevant to where it started.

Additionally, I know it’s not very big, but look at the growth of the comics category. It started out as barely even a line and has grown considerably. Still, you can see how small the comics category is compared to the overall Kickstarter ecosystem.

I was also surprised to see how much the Technology category grew, even though the success rate plummeted. What it shows me is that a lot of people are attracted to the platform but not putting in the work to grow their audience before launch. I also know technology projects tend to be enormous in scope compared to something like publishing.

Fashion and Design also had massive growth spikes, while Publishing seems to have been relatively stable throughout. What this doesn’t show is the fiction category post the March 2022 Brandon Sanderson $41.2 million campaign. That single campaign alone made more than the whole comics category in 2022, and drove a massive number of fiction campaigns, especially fantasy ones, to the platform.

Early in 2023, it was hard to find 10 campaigns in the fiction category. Now, there are often over 100 fiction campaigns launching at any one time, which is a huge increase.

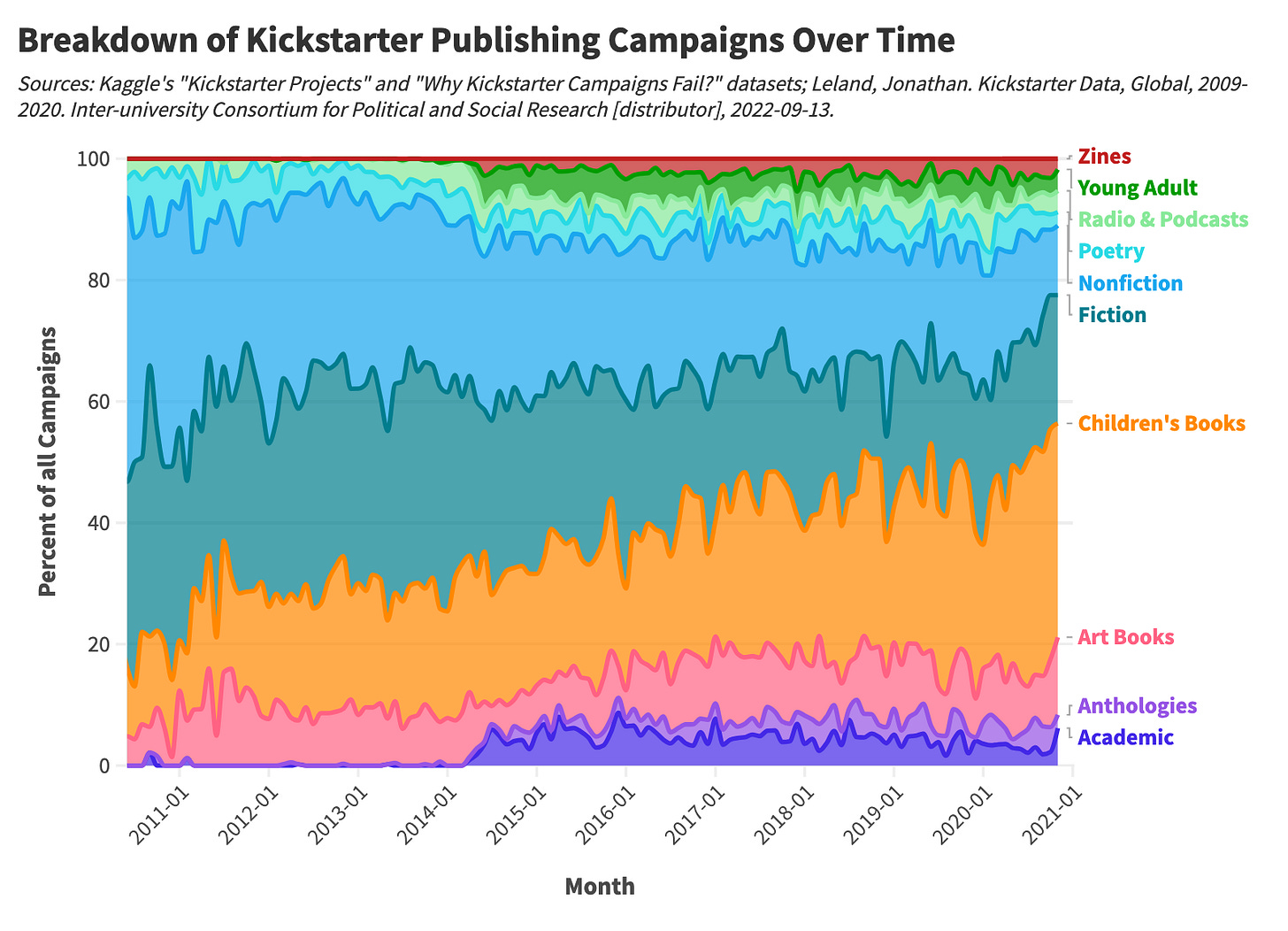

Daniel: In this view, we’re examining the breakdown of project types within the publishing category, focusing on the ten largest sub-categories. My main takeaway from this chart is that children’s books have significantly grown their Kickstarter footprint over time.

Russell: Wow. Look at that huge leap for Children’s Books. At one point they made up 25% of the entire Publishing category, which makes sense since they are often expensive to produce and need large print runs to make the economics work.

I’m really interested to know what happened in 2014 with anthology books. I wonder if they started the subcategory for both Academic and Anthologies in 2014 which is why they were negligible before. A similar story might be true with Zines, Young Adult, and Radio & Podcasts.

Another really interesting statistic is how the Nonfiction area significantly contracted. I remember when John Lee Dumas and Pat Flynn used Kickstarter and brought a ton of visibility to the platform. You would have thought that 2020 would have brought a lot of those people to the platform, but it doesn’t seem that was the case. If anything it shrunk the Nonfiction market.

I would love to see the current data for fiction books. More than anything the last two years has been the story of fiction authors seeing the value of Kickstarter and building it into their business as a crucial step in their publishing journey.

Daniel: This graph showcases the average funds raised per campaign over the last ten years, broken down by project type. This information is useful for two reasons: 1) it gives an understanding of funder appetite for these projects, and 2) it gives us a directional sense of the average campaign target for each sub-category.

Russell: Nothing in this data surprises me. Art Books, Anthologies, and Children’s Books are very expensive to produce, so it would make sense that successful campaigns would have the highest Average Funds Raised. A Fiction book could have a goal of $500 and still make it worthwhile as a step on their journey, but an Art Book generally needs an offset print run, driving up the ask of the campaign.

This data is two years old, and the entire Fiction subcategory really blew up in 2022, especially when authors started using Kickstarter to produce limited-edition hardcover books. I would really be interested in seeing how this has changed since this data. I would expect the average amount raised to have grown significantly since this dataset dropped.

Daniel: This view is similar to the previous chart, examining the average fundraising amount per campaign, but this time grouped by high-level category. Games, design, and technology raise the most funding by a long shot—they are also the most capital-intensive businesses. One thing to note: the average values for each project type may fluctuate over time, but the relative stack ranking of these categories probably remains constant.

Russell: Whoa, look at comics go! Even though it’s a small category, it’s a mighty one, averaging almost $7,500 a successful campaign. That’s mindblowing since we’ve rarely had a seven-figure campaign in the category, especially before 2021.

Then you look at publishing, and it’s still very good, but I think if we looked at the data right now that number will be higher. According to Statistica, the Publishing category made $338 million in 2023.

I can’t find exact data for the Publishing category, but in 2020 the Comics category made $127 million. Last year it made $232 million. If similar growth is consistent for Publishing (and I think there has been more growth is anything, not less), then the Publishing category would have had significant growth since these numbers came out as well, possibly upwards of 80%.

Daniel: This view shows campaign success by publishing sub-category over the past ten years. My best guess is that these values are the product of worthiness and prevalence. Many of the lowest-performing sub-categories are projects that appear most often on Kickstarter (fiction, nonfiction, etc.). The more fiction projects there are on Kickstarter, the harder it is for any one fiction campaign to hit its target amount.

Russell: I don’t agree with Daniel on that point. Comics and games are two of the most successful categories and those creators come back to the platform often. Additionally, they have some of the highest success rates. I think this has to do more with the fact that historically those campaigns were generally poorly put together until the past couple of years. I’d like to see what happened in the intervening years since our methodology has propagated throughout the industry.

I am really surprised to see Art Books and Anthologies with such a high success rate, but maybe I shouldn’t, at least on the Anthology front. The nice thing about anthologies is that you have a lot of creators buoying you up. I’m shocked that Nonfiction has such a low success rate, especially since they can use courses and other digital goods to boost their numbers significantly.

I have to say I’m not surprised about fiction. Historically, authors have set absurd goals and constructed terrible campaigns (like a $10k goal with just a stick figure and one paragraph. It’s gotten a lot better since 2021, though, especially with the methodology we created for the Publishing category, especially for fiction books. I would expect this number to be way higher if we looked at current data.

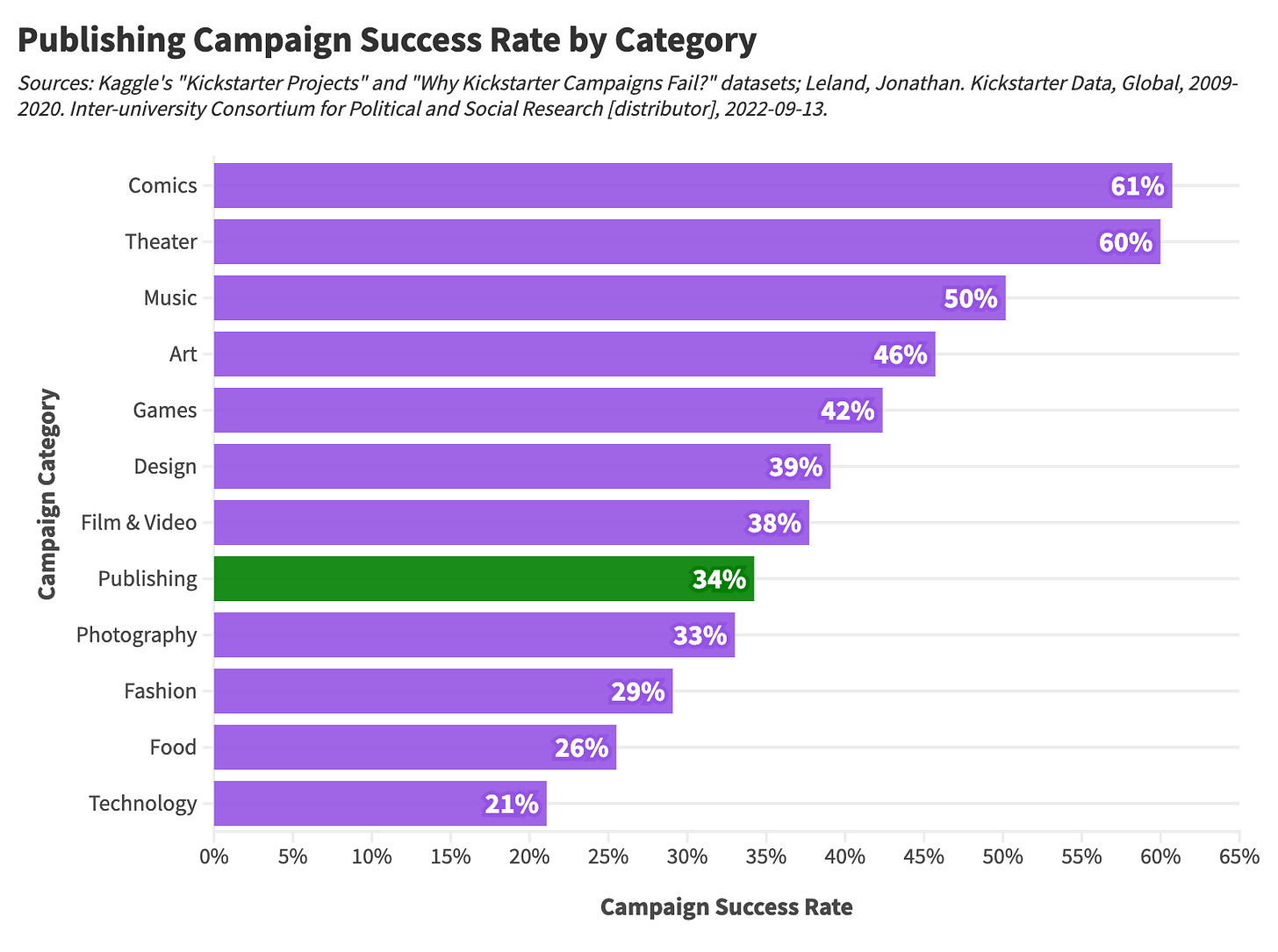

Daniel: This final graphic showcases the campaign success rate by high-level category for a decade’s worth of fundraisers. Comics and theaters are major outliers in their success on Kickstarter. Technology has the lowest success rate, likely due to the high target amount commanded by these projects.

Russell: Yaaaaas! Comics is an amazing category, even though it’s small. The reason they have such an extraordinary success rate is because the creators cherish the community and return to it consistently. Many creators run their whole business through Kickstarter, running upward of 4-12+ projects a year on the platform. Because it’s such an important part of our business, we treat it with reverence and all work to foster both backer support and creator excellence. This is a big failing of the publishing category right now. Too many authors are launching their books and vanishing into the ether. We need to make Kickstarter a community and use it consistently if we want to mimic the strength of the Comics community.

Final thoughts

This was so much fun. I love data and I love Kickstarter, so this was a real treat. While I’ve seen a lot of Kickstarter data in my career, I’ve never seen anything broken down quite this way before.

My only regret is that I really wish we had data from the past two years. The Fiction category had a revolution since then, and I think if we looked at data for it right now it would be night and day.

Why did we focus so heavily on the Publishing category? For the same reason Monica Leonelle and I wrote a book on the subject…because nobody else would. While there’s a lot of good data on comics and games, Publishing is a black box. I hope we are starting to change that in our way by doing things like sharing this kind of data with you.

I’ve never worked with a data scientist in this manner to analyze and contextualize so much data. If you enjoyed this one, definitely go subscribe to Stat Significant. Here’s another one of there’s I really enjoyed.

How did you like that one?

Does this spark anything inside of you?

Do you see how you can use crowdfunding in your own business?

Do you have any other context to add or insights we missed?

Let us know in the comments. If you found value here, consider becoming a paid member, where you get access to member-exclusive courses, articles, interviews, lectures, and more, or just leave us a one-time tip to show your support.

This was really interesting, as I'm just starting my research process for an upcoming publishing project! Thank you for this!

An excellent breakdown - and I absolute love seeing the Comics bracket punching above it's weight in that last graph.